Debt-to-Equity D E Ratio Meaning & Other Related Ratios

There are various companies that rely on debt financing to grow their business. For example, Nubank was backed by Berkshire Hathaway with a $650 million loan. When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another.

Contents

Do you already work with a financial advisor?

- Existing customers can receive a rate discount of 0.25% when they set up autopay with a Flagstar bank account.

- If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio.

- Discover Bank started in 1985, when big box retailer Sears added financial services.

- On the other hand, investors rarely want to purchase the stock of a company with extremely low debt ratios.

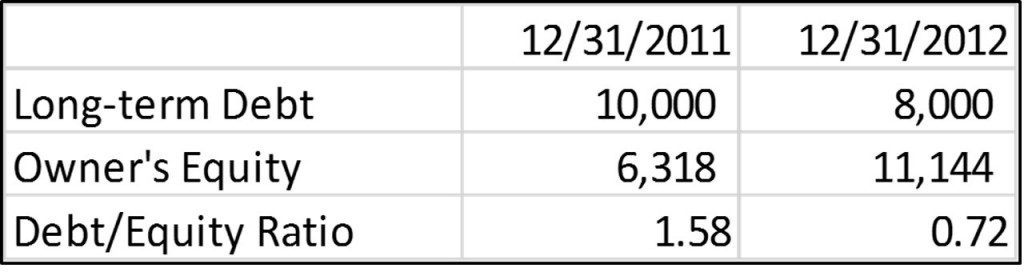

Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000. The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky.

How We Make Money

A higher debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom. The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. A high-debt-to-equity ratio isn’t bad but is often a sign of higher risk.

Residual income

When assessing D/E, it’s also important to understand the factors affecting the company. While a useful metric, there are a few limitations of the debt-to-equity ratio. As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context.

It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. A home equity loan is a kind of second mortgage — a lump sum loan backed by your home’s value. Not all lenders offer home equity loans, but borrowers are attracted working at xerox in amsterdam to them because they have lower interest rates than credit cards or personal loans. Understanding the average Debt to Equity ratio in your industry helps contextualize your company’s financial standing. This comparison can inform strategic decisions regarding financing and growth.

What is your current financial priority?

Therefore, the D/E ratio is typically considered along with a few other variables. One of the main starting points for analyzing a D/E ratio is to compare it to other company’s D/E ratios in the same industry. Overall, D/E ratios will differ depending on the industry because some industries tend to use more debt financing than others. On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either.

This is because a 0% ratio means that the firm never borrows to finance increased operations, which limits the total return that can be realized and passed on to shareholders. In terms of risk, ratios of 0.4 (40%) or lower are considered better ones. As the interest on a debt must be paid regardless of business profitability, too much debt may compromise the entire operation if cash flow dries up.

Debt-to-equity ratio is just one piece of the puzzle when it comes to evaluating stocks. Whether the ratio is high or low is not the bottom line of whether one should invest in a company. A deeper dive into a company’s financial structure can paint a fuller picture. “Some industries are more stable, though, and can comfortably handle more debt than others can,” says Johnson. For example, manufacturing companies tend to have a ratio in the range of 2–5. This is because the industry is capital-intensive, requiring a lot of debt financing to run.

Therefore, it’s often necessary to conduct additional analysis to accurately assess how much a company depends on debt. Understanding a company’s debt profile is a critical aspect in determining its financial health. Too much debt and a company may be in danger of not being able to meet its interest and principal payments, as well as creating a strain on its finances.

Depending on the industry they were in and the D/E ratio of competitors, this may or may not be a significant difference, but it’s an important perspective to keep in mind. You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website.

Bookkeeping -Direct Materials Quantity Variance

Direct materials quantity variance explanation, formula, reasons, example

Is Accumulated Depreciation an Asset? How to Calculate It?

CDs or Money Market: Which Pays More?

Free General Ledger Templates

How a General Ledger Works With Double-Entry Accounting Along With Examples

Taxpayer identification numbers TIN Internal Revenue Service